Africa remains oil hunt hub

Namibia a hive of activity

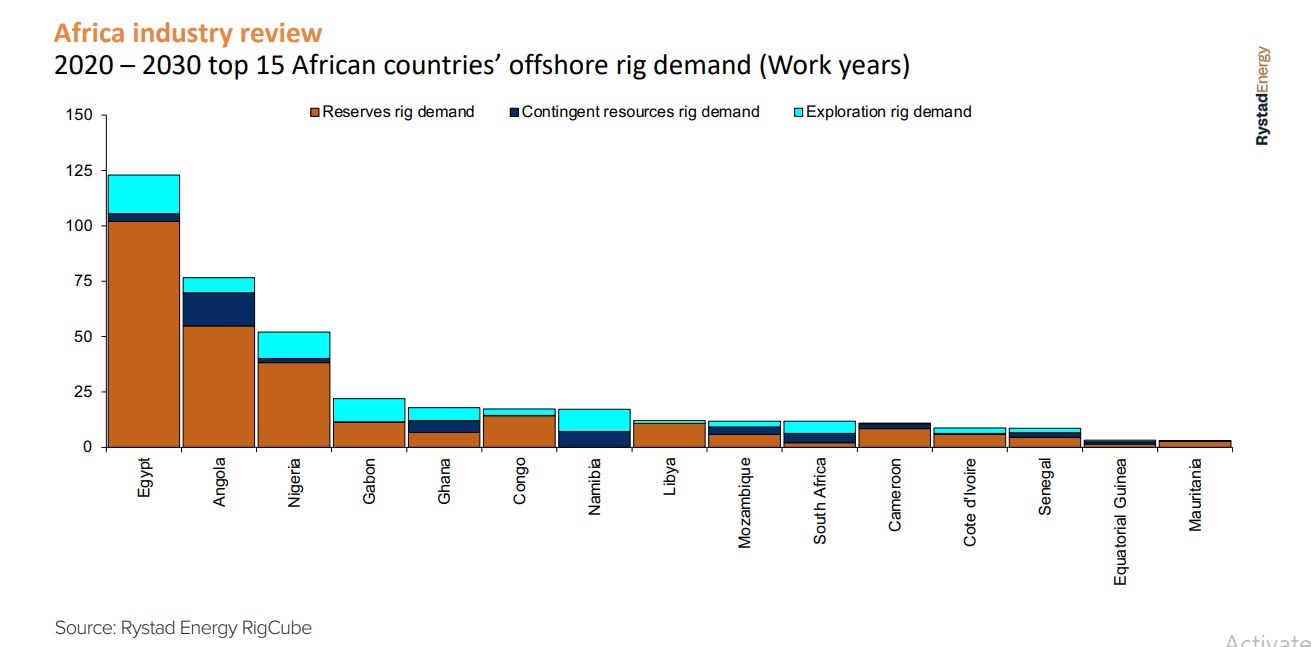

Namibia, South Africa, Equatorial Guinea, Ghana and Mozambique are the top five countries with the highest percentage of rig demand being related to contingent resources.

Africa exploration drilling, which consists of drilling of both wildcats and appraisal wells, is expected to see a steep growth from 2022 levels. The trend is relatively flat through to 2025, the African Energy Chamber says in its 2024 Outlook Report.

The total cumulative well count over 2023 to 2025 is about 375.

Estimated annual exploration well count is 132 wells in 2023, 120 wells in 2024, and 123 wells in 2025.

Two-thirds of the total wells are expected to be onshore, and a little over a fifth of the total wells are estimated to be in the deep waters off Africa.

Countries

Onshore drilling is majorly driven by the expected exploration activity in Algeria and Egypt, with the exploration well count in these two countries estimated to be almost two-thirds of the total onshore exploration well count.

Mega discoveries in the deep waters off Namibia have kicked off exploration in the region, and the country, along with Nigeria and Egypt, is expected to drive the deepwater exploration drilling over the period.

Similar to the remaining recoverable resource, supply and spending potential, national oil companies (NOCs) and majors are expected to drill close to 50% of the total exploration wells between 2023 and 2025.

High impact wells

Another positive indicator for Africa’s exploration activity is the expected high impact well (HIW) drilling in the continent.

Classification of exploration wells as HIWs has to satisfy one or more of the following five criteria:

• Large prospective resources: significant pre-drill estimates by company;

• Focus for company: company is pushing for the well;

• Emerging basin: well being drilled in area with mostly exploration success, but little production yet;

• Play opener: well is targeting a new play in mature or frontier area; and

• Frontier basin: well being drilled in a completely new frontier.

Last year already saw six such HIWs drilled across Africa – one in Mauritania by Shell Plc, one in Gabon by CNOOC, Venus-1A in Namibia by TotalEnergies, and Jonker-1 by Shell Plc offshore Namibia, one well – Raia-1 offshore Mozambique by Eni, and finally one well by Eni in Egypt.

Eleven more HIWs are expected to be drilled in the next 15 months. Two wells – Cinnamon in Morocco by Eni and an exploration well in the Shell Plc operated North Marina block in Egypt – are confirmed to be drilled before the end of this year.

This year is also expected to see two more HIWs – Niamou-1, operated by TotalEnergies in Congo, and Osprey well offshore Namibia by Eco Atlantic, but the probability is relatively lesser.

Seven HIWs are expected to be drilled through 2024 in both mature as well as frontier areas with participation from majors, independents and E&Ps alike.

Activity

Wells drilled on the African continent and its continental shelves ultimately represent the activity that ensures hydrocarbon recovery from its underground deposits.

An estimated 810 wells were drilled during 2020, with about 651 or 80% drilled onshore and the remaining 159 or 20% drilled offshore. The trend since then has been an increasing number of wells drilled per year in the post-pandemic era.

In 2021, the overall drilling rose to about 820 wells, with a similar split of 80% of those drilled onshore and 20% offshore. In 2022, drilling levels saw an 11% year-on-year (y/y) increase over 2021, with 910 wells drilled in total.

The number is estimated to increase to 967 wells in 2023, a 6% y/y growth, and further to 1013 wells in 2024, representing a 5% y/y growth. Increasing drilling activity onshore in the northern and eastern parts of Africa is the main driver behind this growth.

Count

Beyond 2024, drilling activity is expected to see a gradual decline equivalent to an average 6% per annum through to 2030.

The 2025 well count is estimated at about 960 wells (onshore vs offshore – 180 wells (19%) vs 780 wells (81%)), and at the current expected activity levels, performance of the wells vs actual supply, the count is estimated to drop to about 715 wells – 130 offshore (18%) and 585 onshore (82%) wells.

It is also to be noted that the average split between onshore wells vs offshore wells is expected to remain roughly at 80%-20% split through the period.

The number and type of wells can be translated into rig demand expectations, in other words, how many drilling rigs have to be operational for a year in order to drill the wells?

Jackups are typically used in shallow water with water depth up to 125 meters, while floaters serve drilling demand in deeper waters.

Rig demand

The rig demand pattern is roughly similar to the estimated number of wells drilled per year.

As the number of wells drilled per year increases over the period 2020 to 2024, rig demand evolution also saw a similar pattern with demand of about 28 years per year over 2020-2021, growing to 37 years, 40 years, and 44 years for the years 2022, 2023, and 2024 respectively.

The 2024 rig demand represents a 55% growth over that of 2020.

This suggests that the rebound that was expected from the pandemic lows happened as significant drilling associated with projects currently under development returned to Africa from 2022.

However, going forward, the rig demand – in line with the expected/estimated wells to be drilled per year – is in a declining trend.

It is also to be noted that the rig demand expansion to an average 44 rig years over the year 2024 is contingent on new projects being sanctioned.

The current oil market outlook, greenfield and brownfield investment forecast suggests the combined potential of these new projects and further exploration activity will be able to propel rig demand in Africa towards pre-Covid-19 levels.

Decline

It is to be noted that the rig demand from the existing projects in the pipeline is expected to decline marginally through 2025 to 2030 and it is the combined impact of rig demand driven by projects contingent on FIDs and exploration that is the driving factor for increase.

Any delays in these expected FIDs and/or exploration drilling can lead to further decline and thus, an obvious blow to production going forward.

Breaking down cumulative offshore rig demand from 2020 to 2030 per country reveals Egypt as the most active country with about 123 rig years followed by Angola and Nigeria.

The breakdown of the top 20 countries by rig demand with associated split on what resource class is supporting the rig demand suggests the majority of the rig demand is robust with only about 32% related to contingent resources and exploration.

Namibia, South Africa, Equatorial Guinea, Ghana and Mozambique round off the top five countries with the highest percentage of rig demand being related to contingent resources implying that rig demand in this particular area is sensitive to investment decisions expected over the period.

Most other producing countries show very little dependence on upcoming project sanctions to drive their rig demand. – African Energy Chamber