Company news in brief

ReconAfrica targets 15bn barrels of oilReconnaissance Energy Africa (ReconAfrica) has announced a significant increase in the estimated prospective oil resources in Namibia, indicating a potential unrisked 15.4 billion barrels of oil in place.

The Canadian company provided an updated prospective resource estimate on the Damara Fold and Thrust Belt Area, located within Trigon’s petroleum exploration licence (PEL 73) in the Kavango Basin in Namibia.

ReconAfrica has a 90% working interest in PEL 73.

ReconAfrica said it has reviewed an extensive amount of data over the past months. This has “only increased our excitement for the planned upcoming drilling campaign in both the Damara Fold Belt and Rift plays,” said Chris Sembritzky, senior vice president of exploration at ReconAfrica.

“We firmly believe that this endeavour has the potential to unlock significant resource,” Sembritzky added.

Last month, ReconAfrica said plans to spuds its first well in the Damara Fold Belt in June this year.

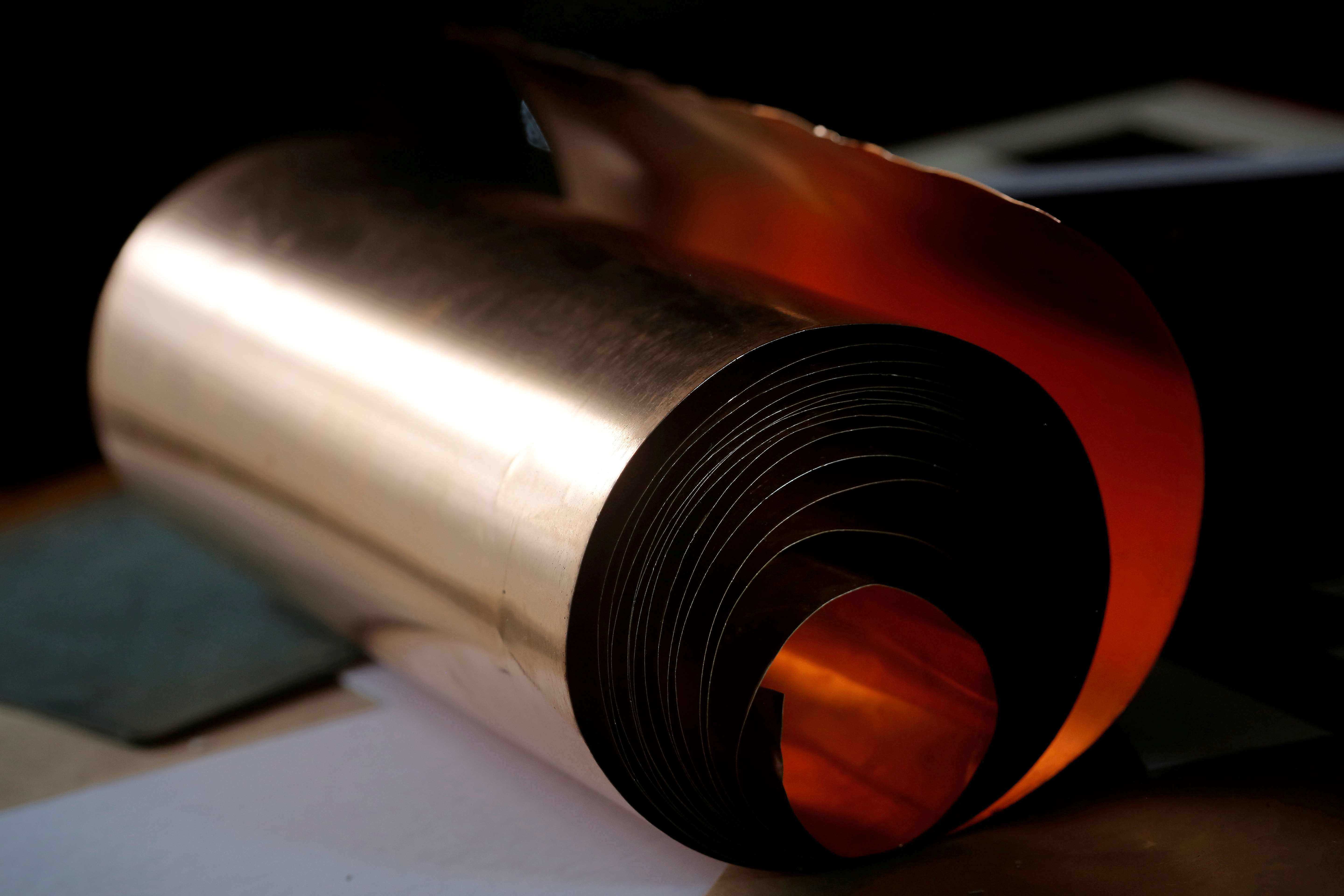

Trigon ups stake in Kalahari Copperbelt Project

Trigon Metals Inc, owner of the Kombat copper mine, has acquired Mauritius-based Base Metal Investments and Services, which holds an option to acquire up to a 70% stake in the Kalahari Copperbelt Project in Namibia.

This allows Trigon the right to attain up to 70% interest in Copperbelt Exploration, which wholly owns the Kalahari Copperbelt Project, the Canadian company said in a statement.

The Kalahari Copperbelt Project comprises an extensive land area in Namibia, featuring key exclusive prospecting licences (EPLs) spanning 280 km along the Kalahari Copper Belt's strike. This belt is renowned for its hosting of exceptional copper and silver deposits.

As consideration for the acquisition, Trigon, on behalf of Base Metal, has paid USD$60 000 or about N$1.1 million to Ongwe Minerals, the vendor of Copperbelt. Trigon has also committed to funding US$1 million or about N$18.7 million in exploration expenditures on the project over the next 24 months.

“Namibia is an attractive jurisdiction for mining, characterised by a stable and effective government, a reliable judicial system, good infrastructure and a favourable investment environment,” Trigon said.

Deep Yellow suffers loss again

Deep Yellow, the Australian uranium mid-cap company that plans to build the Tumas mine in Namibia, reported a total comprehensive loss of nearly US$5.9 million for the six months ended 31 December 2023.

In the same half-year in 2022, the company’s loss amounted to nearly US$6.4 million.

Deep Yellow reported a basic loss of US$0.82 for the period under review, compared to a basic loss of US$0.76 for the same six months in 2022.

Last week, Deep Yellow received binding commitments to raise A$220 million, more than N$2.7 billion, to move its Tumas uranium project towards production.

The company expects a final investment decision late in the third quarter of this year. Should investors give it the go-ahead, Deep Yellow will start constructing the Tumas mine thereafter.